What if your UNIQUE Lifting Needs could be

solved for the price of a few hundred dollars?

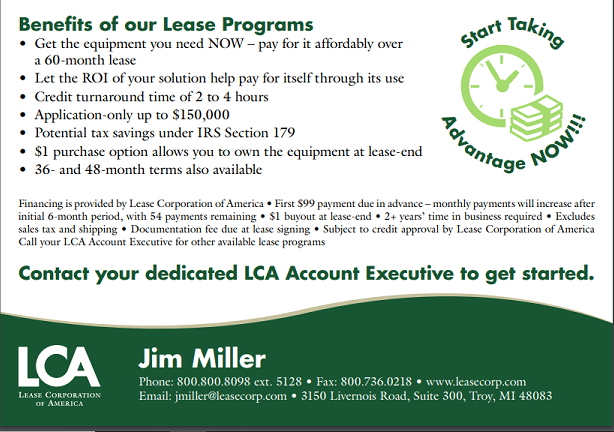

How about less than $100, that’s per month on a lease (for the first 6 months). Do you see how our EzRig Crane could pay for itself in maybe the first usage? Even purchasing outright can return an ROI after a few uses.

The government is even helping you. Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Read all about the Section 179 Deduction …

Here’s who we use for you to get leasing (they can even turn around a quote and approval status for you in about a day):

If you’d like to get the full price, including shipping to your location, and any applicable taxes, give us a call at EzRig Crane, 805-643-4387 or use the contact us form.